The Idaho Patient Act: Protecting Idahoans

We believe that with a little transparency and better billing practices, patients will be better able to pay their bills in full. Fewer medical debts will end up in collections which will help patients and doctors alike.

Under IPACT

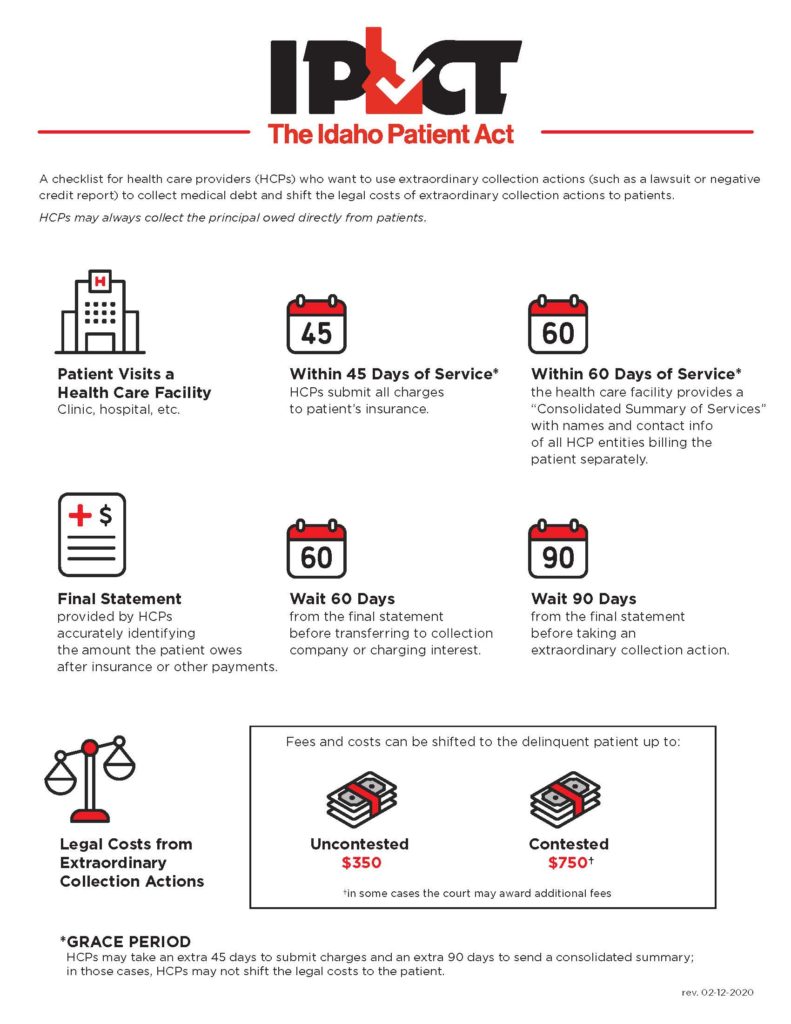

- Doctors will submit charges within 45 days of seeing a patient.

- Patients will receive a single list of everyone that’s going to bill them.

- Appropriate grace periods allow time to correct errors.

- Attorneys’ fees will be limited so patients are protected from outrageous medical debt collection fees.

- Doctors will be paid more timely because patients will understand their bills and can pay with confidence without delay.

Myths and Facts

MYTH: If a health care provider does not comply with IPACT, a patient does not have to pay for services.

FACT: A health care provider (HCP) can always submit charges to the third-party payor (“Insurance”) and collect remaining principal and interest through normal collection efforts such as sending bills, making phone calls, asking for payment, arranging a payment plan, or using a collection agency 60 days after a patient receives a final statement.

MYTH: An HCP must provide the patient a final statement (bill) 45 days after service.

FACT: To engage in extraordinary collection actions*, HCPs must submit charges to a patient’s insurance within 45 days. A final statement may be sent any time after the HCP and insurance have resolved the charges and amounts owed by the patient. If the patient did not provide insurance at the time of service, HCPs should submit charges to the patient within 45 days.

MYTH: If a patient has multiple third-party payors, HCPs must submit the charges to all third-party payors within 45 days.

FACT: IPACT does not change current laws and regulations regarding proper submission in the event of multiple third-party payors except as to the timing for submission to the first third-party payor. HCP should consult with the patient and/or exercise its best judgment in determining which third-party payor to submit charges to first. Supplemental or other third-party payor submissions can follow at any time. In other words, an HCP should begin the insurance process by submitting charges to one of the third-party payors within 45 days. There is no time limit on subsequent insurance submissions other than what is provided in the contracts.

MYTH: If an HCP misses the 45-day window to submit to insurance, the HCP cannot collect.

FACT: IPACT does not affect contractual submission deadlines between third-party payors and HCPs. IPACT addresses the timing of submissions to third-party payors and notifications to a patient when the HCP takes an extraordinary collection action against a patient.

If an HCP missed the 45-day window, IPACT provides for an additional 45 days to submit the bill. Essentially, an HCP has 90 days to submit the bill and still use extraordinary collection actions. The only difference is that after the first 45 days, an HCP cannot shift any of the costs and fees of extraordinary collection actionsto the patient.

If the submission to insurance has not occurred within 90 days of the date of medical service or discharge from a health care facility, the HCP can still submit the bill to third-party payors and continue to make normal collection efforts on any remaining balance but may not engage in extraordinary collection actions.

MYTH: If the patient provides insurance 45 days after service or does not provide accurate insurance at the time of service, the HCP does not have to comply with IPACT.

FACT: It is the patient’s responsibility to provide accurate insurance information at the time of service. If the HCP submitted the bill to the insurance provided, and the claim is denied for any reason, for the purposes of IPACT, the HCP has met the timing requirements for the 45-day submission. Under those circumstances, the HCP is compliant even if the patient provides corrected or supplemental information at a later day.

Please note:If the patient does not provide insurance information at the time of service, to comply with IPACT, the HCP should submit charges to the patient directly within the appropriate time frame.

CONSOLIDATED SUMMARY OF SERVICES

MYTH: All HCPs must provide a Consolidated Summary of Services.

FACT: The health care facility at which the patient received services provides the consolidated summary for its own HCPs and any independent contracting HCPs who will bill patient separately.

IMPORTANT NOTE: If the health care facility and the HCPs who provided service are all billing on one final statement, then the health care facility and HCPs do not need to provide a Consolidate Summary of Services. The health care facility must notify the patient in writing at the time of service that the patient will receive one bill for the services rendered at the health care facility.

MYTH: The Consolidated Summary of Services is a combined bill with pricing information.

FACT: The Consolidated Summary of Services must include the name and contact information of the health care facility, the date(s) of service, the names and contact information of each HCP or entity billing the patient separately, and a general summary of services provided. The Consolidated Summary of Services is not a combined bill; it is a notification to a patient to expect more than one HCP to bill separately for services.

MYTH: If the health care facility misses the 60-day window to send the Consolidated Summary of Services, the HCP cannot collect.

FACT: An HCP can always collect its principal and interest through normal collection efforts (e.g., sending bills, making phone calls, and asking for payment). If a health care facility missed the 60-day window, IPACT provides for an additional 90 days to provide the Consolidated Summary of Services. Essentially, a health care facility has 150 days (approximately 5 months) to inform the patient of the HCPs that will be billing the patient separately. The only difference is that after the first 60 days the costs and fees of extraordinary collection actions cannot be shifted to the patient.

If the Consolidated Summary of Services was not received within 150 days of the date of medical service or discharge from a health care facility, normal collection efforts may always be used.

MYTH: Third-party payors are better suited to send the Consolidated Summary of Services.

FACT: Third-party payors are only aware of bills that have been submitted by the HCP. Only the health care facility has full access to the services provided and, therefore, can inform the patient in a timely manner of those services. This provides a patient with the opportunity to confirm with the third-party payor that the HCPs identified on the Consolidated Summary of Services have properly submitted their bills to the third-party payor.

MYTH: Once a patient receives a final statement, an HCP must wait 90 days to collect.

FACT: The HCP can always collect the principal balance and interest owed. During the 90-day period before extraordinary collections actions can be taken, an HCP can ask for payment, send multiple notices requesting payment, warn of the possibility of collection actions in accordance with the Fair Debt Collection Act, make phone calls, and after 60 days send the balance to a collection agency.

An HCP or the third-party collection company may not engage in extraordinary collection actions unless the HCP has complied with the notice requirements and 90 days have passed since the patient received a final statement.

PROVING RECIEPT

MYTH: The HCP or health care facility are required to use registered mail to send the notices.

FACT: The HCP can deliver the notices however it sees fit including at the time of service, first-class mail to the address the patient provided, patient portal, or email. In the event of a court proceeding, the HCP has the burden to prove receipt—first-class mail to the address the patient provided at the time of service creates a rebuttal presumption of receipt in favor of the HCP.

GENERAL

MYTH: IPACT caps how much interest an HCP can charge.

FACT: IPACT does not limit interest rates. IPACT stipulates that the outstanding debt may not begin to accrue interest until 60 days after the final statement was received by the patient.

MYTH: An HCP or its agent who never engages in extraordinary collection actions must still comply with IPACT.

FACT: No. HCPs are not required to satisfy the conditions of IPACT unless they intend to engage in extraordinary collection actions.

MYTH: The Idaho Patient Act is mandatory regulation.

FACT: IPACT sets sideboards on extraordinary collection actions. There is no government agency that is tasked to implement this bill. No government funds need to be appropriated for this bill to operate. Rather, IPACT sets sideboards on extraordinary collection actions* and allows health care providers, collections agencies, and attorneys to choose whether they wish to avail themselves to the benefits of the use of those measures.

EXTRAORDINARY COLLECTION ACTIONS & ATTORNEY FEES

MYTH: The HCP may not use a third-party biller to send out notices.

FACT: The HCP may use a third-party biller. Nevertheless, the third-party biller must adhere to the same requirements as an HCP before engaging in any extraordinary collection actions.

MYTH: IPACT limits how much a collection company can be paid.

FACT: IPACT does not regulate how much collection companies can charge for their services or impact the rates and fees negotiated between collection companies and their clients. IPACT only limits how much of the creditor’s collections costs can be shifted to the patient.

MYTH: IPACT prevents collection companies and doctors from hiring an attorney.

FACT: IPACT does not regulate or prohibit collection companies and doctors from hiring an attorney. As with any attorney-client transaction, collection companies and doctors can hire attorneys, negotiate rates, and pay attorneys’ fees as they see fit. IPACT only limits how much of the creditor’s collections costs can be shifted to the patient.

MYTH: In Idaho, court costs and services fees are at least $350.

FACT: Collection companies and doctors can obtain a default judgment for as little as $119 in most instances. For example, in Ada county filing a case in small claims court (cases under $5,000) costs $69 and service of a small claims action is approximately $50.

MYTH: Even though more expensive, Magistrate Courts are a better venue for patients.

FACT: Small

claim court is specifically designed for cases under $5,000 and is more user

friendly than Magistrate Courts.

In small claims courts patients:

- do not pay a fee to file an answer,

- do not need an attorney, and

- can use court approved forms to participate in the process.

* Extraordinary collection action means suing a patient, reporting a patient’s failure to pay a debt to a consumer credit agency, or not waiting at least 60 days after a final statement to use a third-party collection agency to recover the debt from a patient, among other things. Extraordinary collection action does not include normal collection activities of health care providers such as sending bills, making phone calls, asking for payment, arranging payment plans, or using a third-party collection company 60 days after a final statement.